Hey, good morning! This is Rich with Summit Life Group. Today, I want to share some information specifically for independent, entrepreneurial business owner life insurance agents who are looking to scale and grow their independent businesses. If you’re in this category, I have some important insights for you. If you’re a life insurance agent working in a call center, employed, or a W2 agent, while I hope you find value in this blog, my focus is really on those agents who are aiming to grow and scale their businesses.

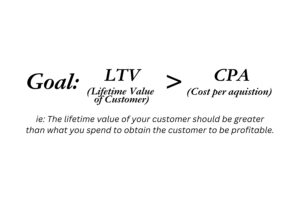

I want to give you two important metrics that you need to be tracking as an independent agent if you want to grow and scale your business. This is very important, so let’s jump right into it.

1st Metric: Cost to Acquire a Customer (CPA)

The first thing you need to start tracking immediately is your cost to acquire a customer. We refer to it internally as our “CPA” (Cost Per Acquisition), but you could also call it your “CAC” (Customer Acquisition Cost). At the end of the day, it’s about knowing how much money you need to invest in marketing to make a sale.

Tracking this is not that difficult. Some of you might think, “Well, I work locally, and I don’t have any cost since I don’t use leads or anything like that.” In that case, your cost could be zero. However, in most cases, even local agents who rely on referral-type processes may still spend money on things like sponsoring charity golf events or putting up billboards. So, there usually is some marketing cost involved, and you need to track that.

If you’re running ads, buying leads, or doing virtual and telesales like we do, where there’s significant lead and marketing spend, it’s crucial to track this number. It’s not difficult at all. The formula is as follows:

Total spend on marketing campaigns may include:

- Spend on lead programs

- Ads

- Sponsored Events

- Anything else you do to advertise

Depending on the product niche you’re working in (we’re specifically in the life insurance space), you’ll learn how high that number can go. But it all starts with tracking it. You need to know what your CPA is—how much it costs you to acquire a customer.

When you first start, it might seem out of whack. One common mistake agents make is looking at it over too short a time frame. For example, if you invest $1,000 in leads or marketing and then look at how many sales you made that week, that’s one way to look at it. But you also need to understand that if you have proper systems in place, you’re going to continue getting sales from those dollars spent. So, you really want to look at it over a longer term.

If you’ve been in the business for over a year, for example, you can look at the total amount you spent on all your marketing and lead generation, and the total number of policies sold. This will give you a very accurate number of your CPA. Determining that number starts with simply tracking it. It’s not complicated. You should know how many sales you’re making in your business, and you should easily be able to track how much you’re spending. But that’s the first metric you really want to make sure you’re tracking.

We started tracking this very early on, and we found the healthy range we needed to stay in. We’re always working to track it and see if we can lower it.

2nd Metric: Lifetime Value of Customer (LTV)

The second metric you need to track is your LTV, or Lifetime Value of your customer. This one is a little more difficult to track than your CPA, but it’s crucial. You need to know the value of a customer over their lifetime. This varies depending on what you’re selling—whether it’s an annuity, final expense, or something else—but you should still attempt to track it.

As a business owner, if you track these metrics, you’ll find ways to improve them. What is measured and tracked can be improved. However, many agents and business owners don’t track these things and miss opportunities for improvement.

When you’re new, you might look at a sale and focus on the immediate deposit you get from that sale, which is important because you need to understand cash flow as a business owner. But like with your CPA, you need to think with a longer-term perspective. What is the lifetime value of that customer? Typically, you’re going to receive additional compensation and commissions, especially in the last three months of the year, and you’ll often get renewal commissions for five or even ten years.

Now, I know some of you might say, “Not everyone pays all the time.” That’s why this is trickier—you must factor in your persistence. But it’s all part of determining the actual value of a customer.

Here’s the bottom line: If you spend X amount to get a sale, and the lifetime value of that customer is Y, then you need to ensure Y is greater than X. If you’re new and just starting out, it might not look that way at first because you’re learning and investing money. But your goal, as you’re growing and scaling, is to lower your cost to acquire customers and increase the value of those customers. It sounds simple, but this is where the nitty-gritty of business processes comes into play.

Instead of saying, “It is what it is,” you need to work at it. As a business owner, ask yourself: What can I do to lower my customer acquisition costs? But be careful depending on your business model, you can’t get so obsessed with lowering costs that you slow your business down. You need to find a healthy range, depending on the product you’re selling.

For example, we know we can drive our costs super low, but if we go too low, we won’t make enough sales, and the system breaks down. This is where a lot of independent agents get stuck—they’re good at keeping costs low but don’t make enough sales. You need to balance it while keeping it in check.

What does it cost to acquire a customer, and what is the value of that customer? And guess what? You can raise the value. Don’t be a victim of circumstances—figure out how to improve your processes to increase the value of your customers.

- What can you do to improve your persistence?

- What can you do to increase your average premium size?

- What can you do to service clients better so you can help them with additional policies?

- Additional sales raise the lifetime value of your clients.

It all works together, but it starts with tracking. That’s the game you’re playing as you scale. If you can lower your CPA to a healthy range and work on increasing your LTV, you’ll create more profit in your business. Once you find profit, your goal should be to scale it.

If you find value in this content please subscribe for more. Have a great day!

Join us: https://slgteam.com